The Accounting Dept. will require an Accounting Invoice to send a payment request to the Customer which Salesperson must generate in the system. The invoices should be accurately created with the most recent and correct information from the confirmed SO. If there are any changes in products, quantities, prices, fees, shipping costs, etc., the invoice must be generated again.

In this SOP the following cases will be explained:

• Generating Down Payment Invoice

• Generating Second Payment Invoice

• Generating 100% Payment Invoice

• Generating Final Payment Invoice

• Re-generating Accounting Invoice:

A: Re-generating the Accounting Invoice before Customer’s payment received

B: Re-generating the Accounting Invoice after Customer’s payment received

• Generating Accounting Invoice for Final Payment of products per shipment

• Generating Accounting Invoices for Late Payment and Storage Fees

A: Generating Accounting Invoice for Late Payment Fee

B: Generating Accounting Invoice for Storage Fee

INVOICE Status

Invoices have 3 main stages that reflect the status of any invoice for the Accounting Dept.

• DRAFT: Initial stage at which the invoice is created. Accounting Dept. must Validate the invoice to be able to print the down payment invoice.

• OPEN: This stage means that the invoice is open and the full amount is not paid.

• PAID: This status means that the invoice has been paid.

• CANCELLED: This status means the invoice has been cancelled.

Generating Down Payment Invoice

The Accounting Dept. will require an Accounting Invoice to send a down payment request to the Customer which Salesperson must generate in the system.

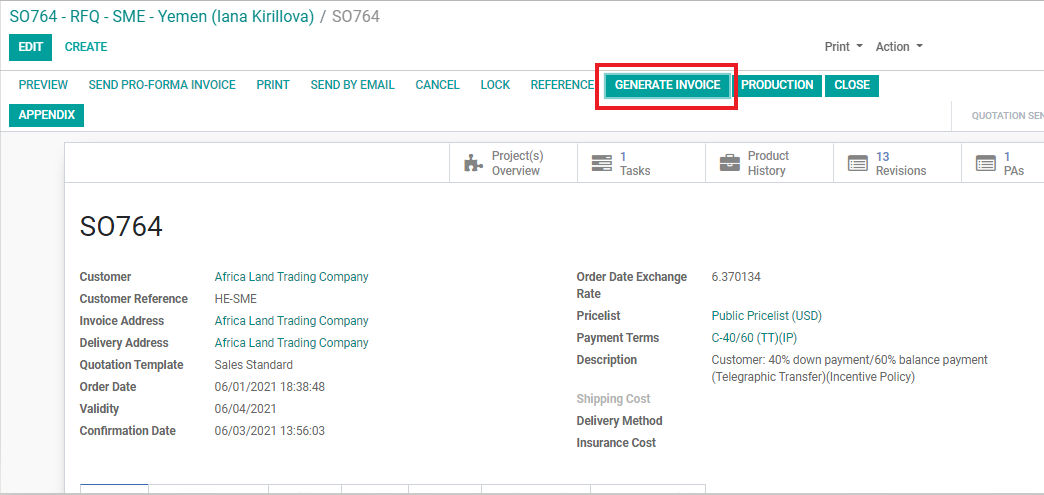

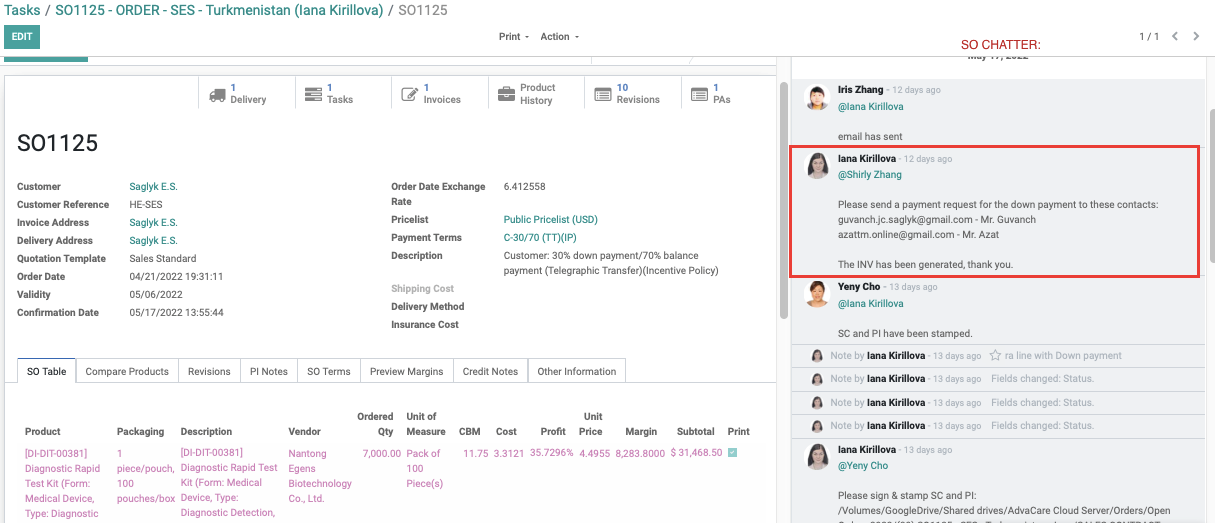

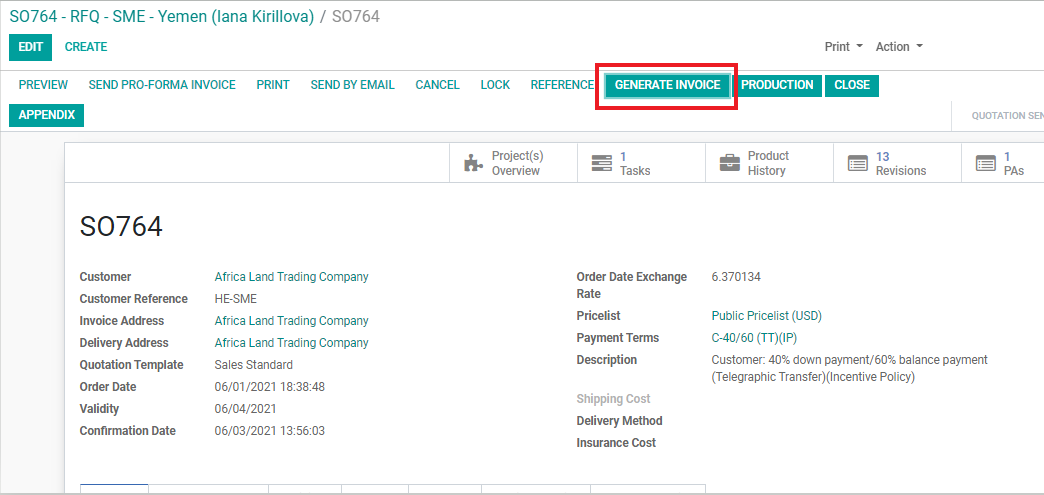

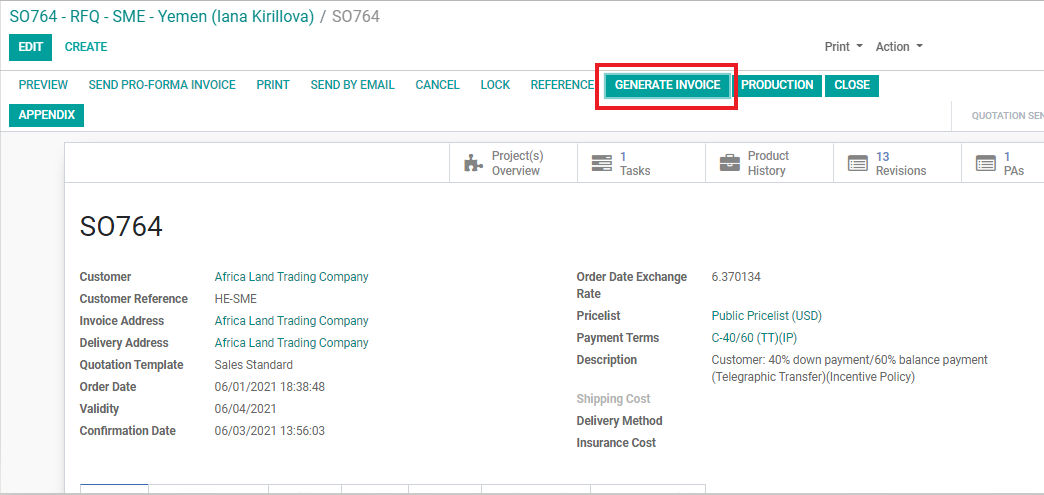

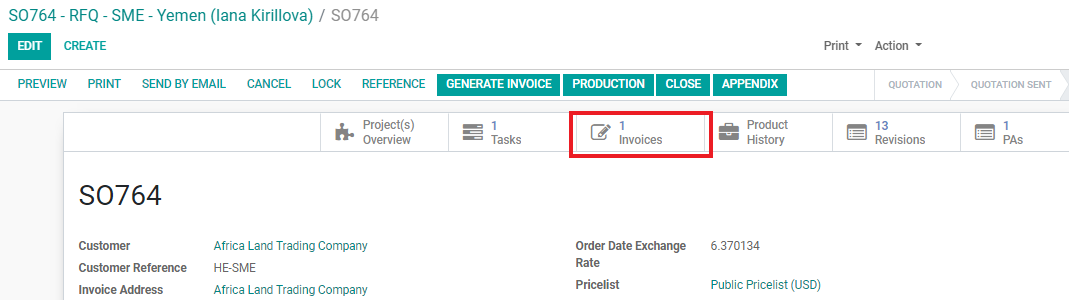

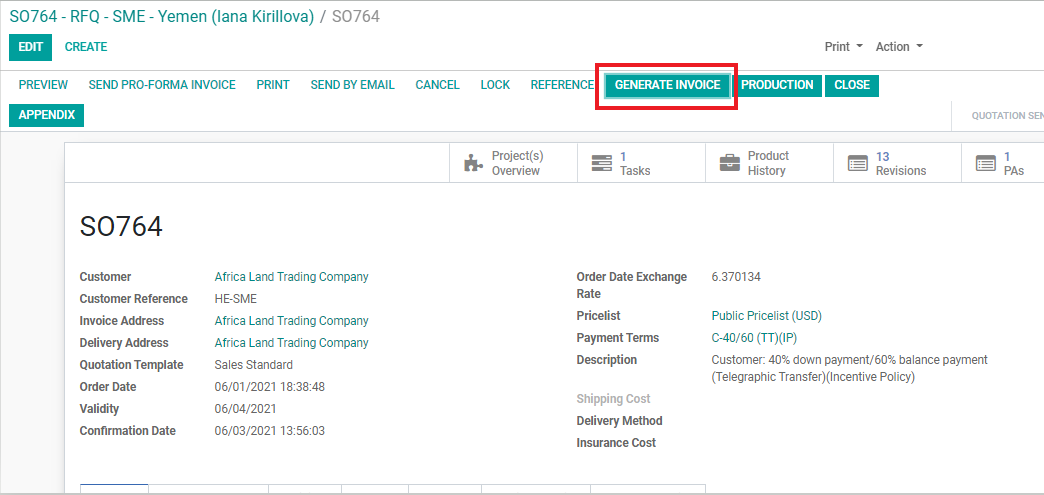

1. Click ‘GENERATE INVOICE’. The order must be in the ‘SALES ORDER’ stage.

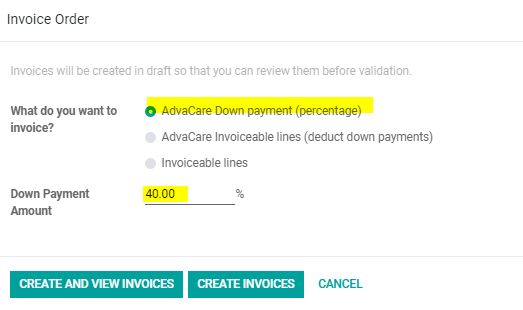

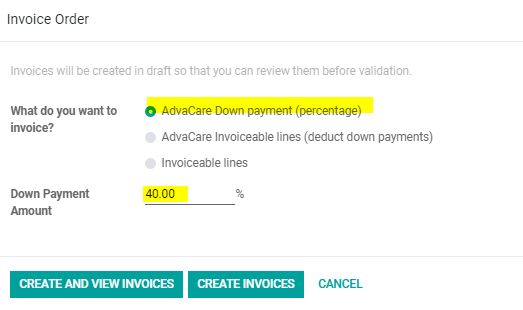

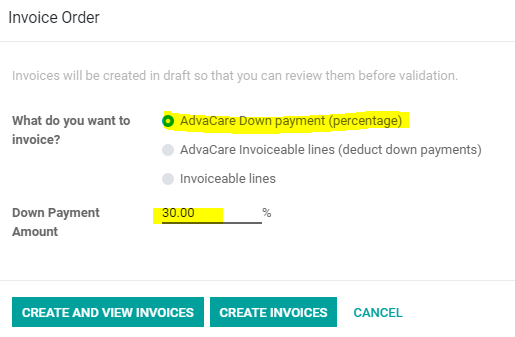

2. To generate the down payment invoice, choose ‘AdvaCare Down payment (percentage)’.

3. Input the Down Payment % amount.

Note: the DP % can be found in the ‘Payment Terms’ line in the SO page (see above photo)

4. Click on the generated invoice to check the amount noted in the invoice is the DP amount.

Note: The Accounting invoices should always match with the sales order. If there are any changes in the sales order of the products, quantities, fees, etc. after the invoice has been generated, Salesperson must cancel the invoice and inform Accounting Dept. via task.

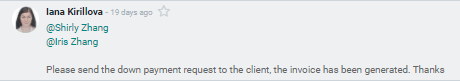

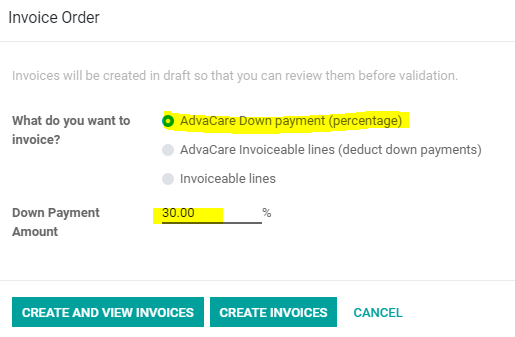

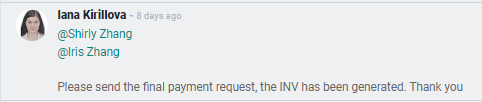

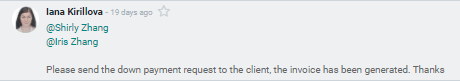

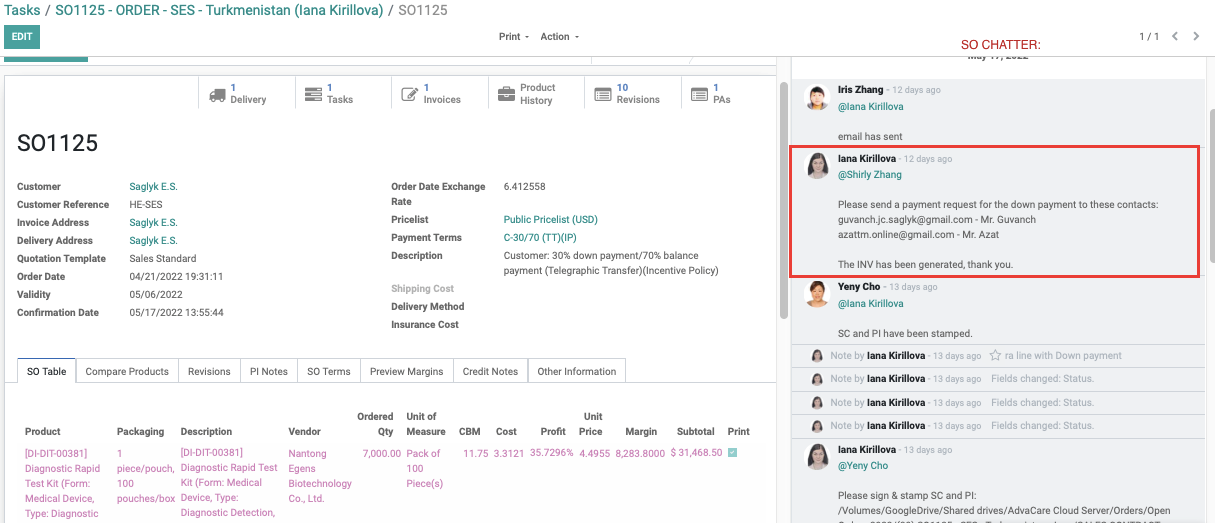

5. Send task to the Accounting person to inform the invoice has been generated and to send the down payment request to the Customer. This task must be sent in the SO Chatter not the SO task.

Note: Any task related to payment, profit margins, Customer prices or Customer information (company name, Customer name, Customer email address(es) should be sent in SO chatter not Project task chatter

Generating Second Payment Invoice

For the payment terms that include more than a down payment and final payment, such as a second payment: (ex: 40/30/30TT), Salesperson will generate the invoice the same way as the down payment invoice.

Note: Salesperson must check the invoice to check the amount is correct based on the total amount of the SO and the payment request. If the amount in the invoice is not correct, there is something wrong with the SO.

Generating 100% Payment Invoice

If the total value of the goods in the Sales Order is less than $10,000 USD, it is AdvaCare policy that 100% advance payment must be remitted before starting production. As mentioned, it is the total value of the goods, not including shipping cost or any other costs/fees related to the products.

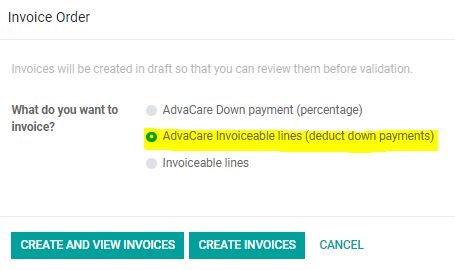

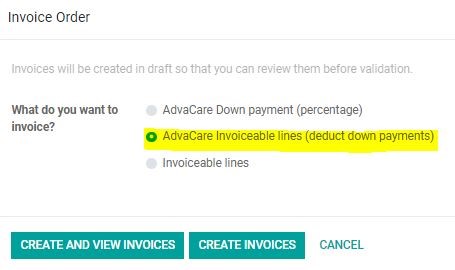

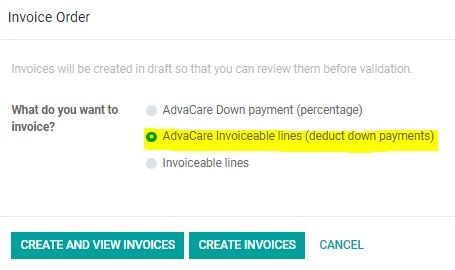

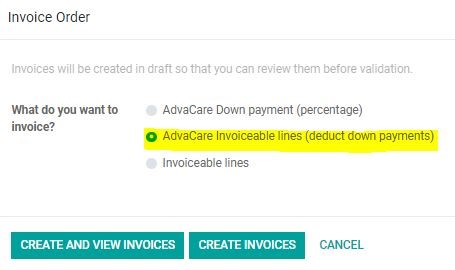

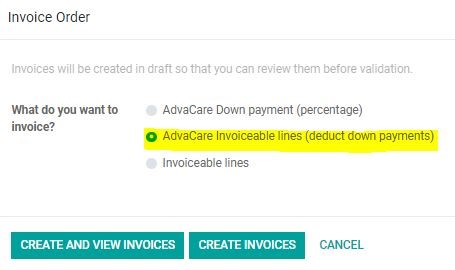

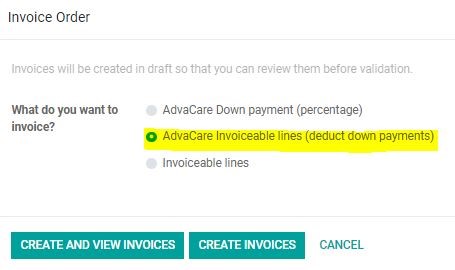

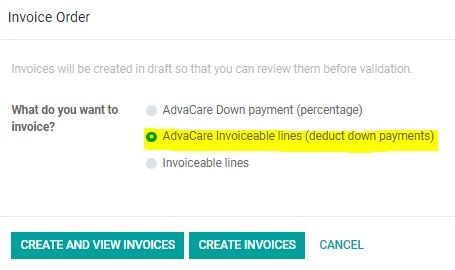

To generate 100% advance payment, click ‘AdvaCare Invoiceable lines (deduct down payments)’.

Generating Final Payment Invoice

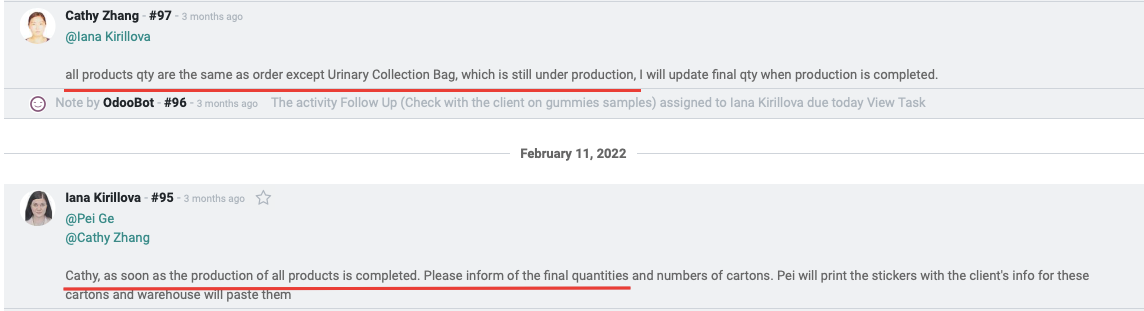

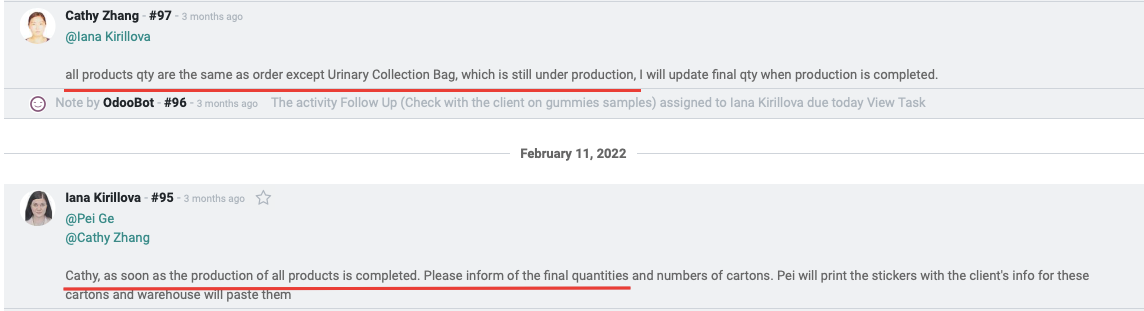

1. Salesperson must check all products’ quantities mentioned in SO with final quantities produced by Vendor. This information must be requested and confirmed with Purchasing Department as soon as the production of the product is completed by sending a task in the task chatter.

2. Click ‘AdvaCare Invoiceable lines (deduct down payments)’ after Salesperson has confirmed final production quantities.

Note: The generated Accounting Invoice must be checked by Salesperson. It must be consistent with Sales Order and include products that will be shipped out. (If the Accounting Invoice has products that are in the SO, but will not be shipped yet, the Accounting Invoice must be revised (Refer to the “Generating Accounting Invoice for Final Payment of products per shipment” chapter below).

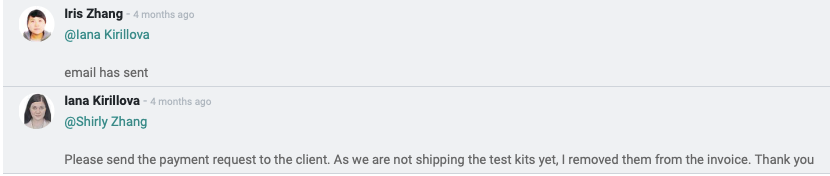

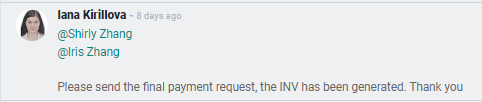

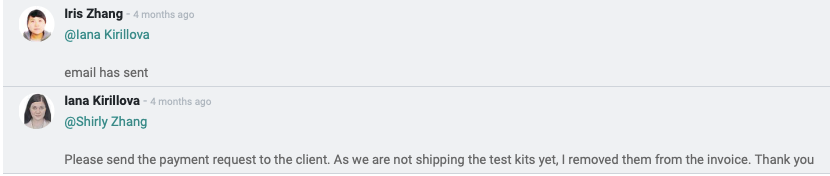

3. Send task to Accounting Department to inform the invoice has been generated and to send the final payment request to the Customer in order to charge Customer for the balance due. Accounting will validate the generated Invoice and send the payment request to Customer by email with the Invoice attached.

Note: some Customers might require Accounting Invoice to be stamped. Salesperson must print the Invoice, sign and stamp by Sales Manager, scan and save in the SO folder on the server “PAYMENT CONDITION”. A link to the scanned Invoice must be sent to Accounting Dept. The task from Salesperson must mention that the stamped and scanned Invoice is required for Customer to complete payment.

Re-generating Accounting Invoice

If Salesperson has already generated Accounting Invoice and Accounting Dept. has sent the payment request to Customer, but for some reason there is a necessity to change the payment request, the Accounting Invoice must be re-generated in order to provide Customer with the revised payment request. (It can happen if Salesperson changes the products, quantities, adds fees or shipping cost).

Depending on the payment status, there are 2 options of how generating new Accounting Invoices must be handled.

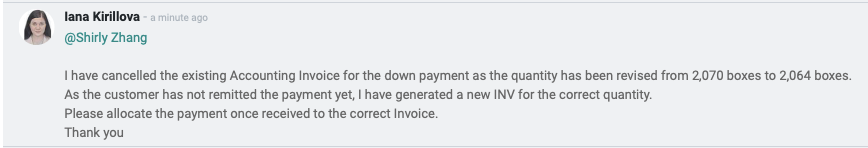

A: Re-generating the Accounting Invoice before Customer’s payment received

If the Customer has not remitted the payment based on the provided request with existing Accounting Invoice, Salesperson must generate the new correct Accounting Invoice by taking 4 steps:

Step 1: Revise the SO accordingly (as mentioned, it can be product-associated revisions, adding fees and costs)

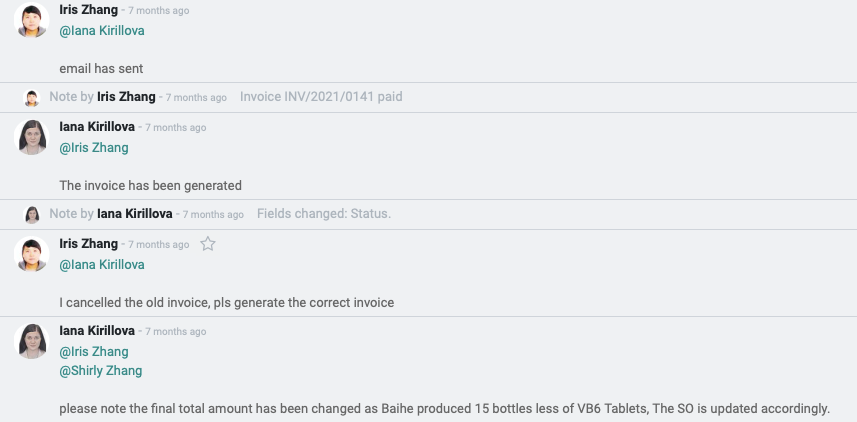

Step 2: Cancel the existing Accounting Invoice

Step 3: Generate a new Accounting Invoice

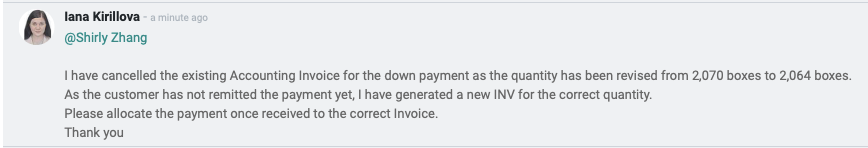

Step 4: Send task to Accounting Dept. to inform of the generation of the new Accounting Invoice via task in SO chatter

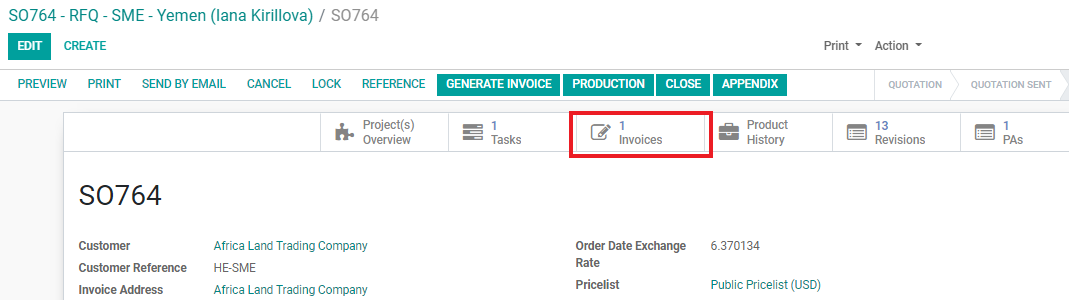

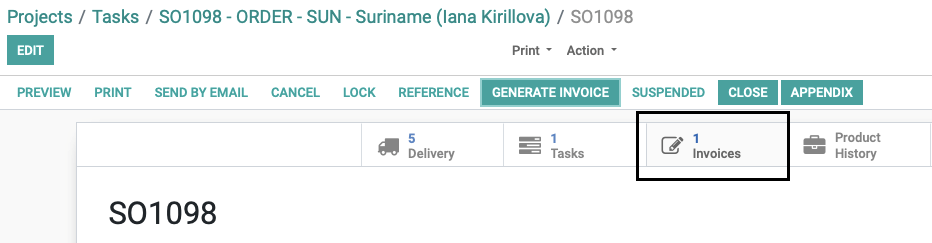

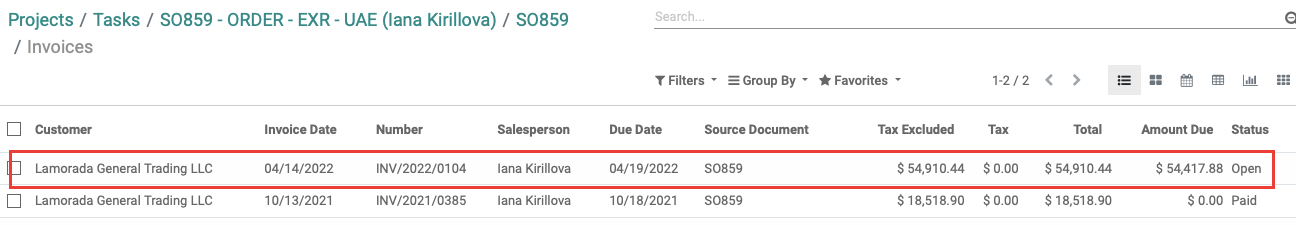

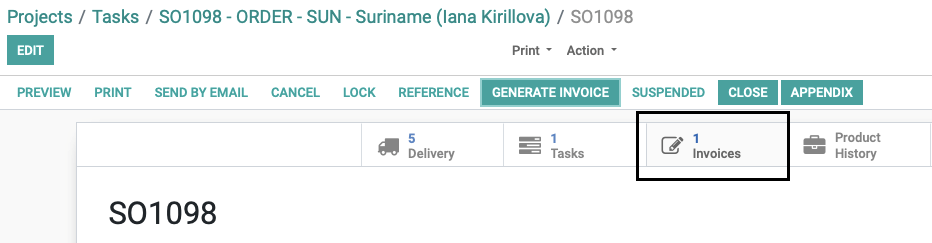

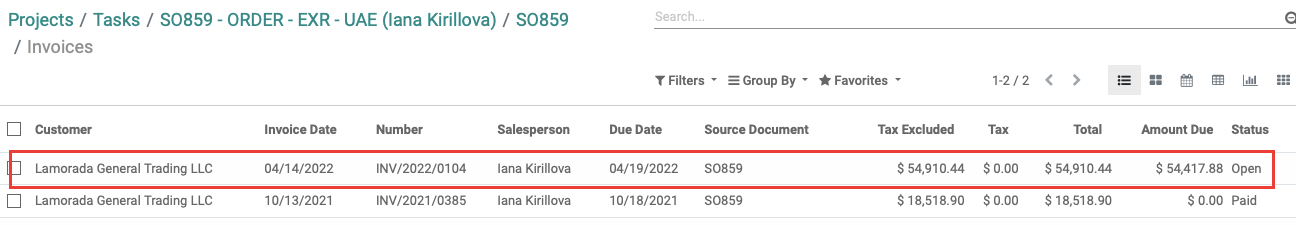

1. Click ‘Invoices’ to open the list of all existing Accounting Invoices for this order in Odoo.

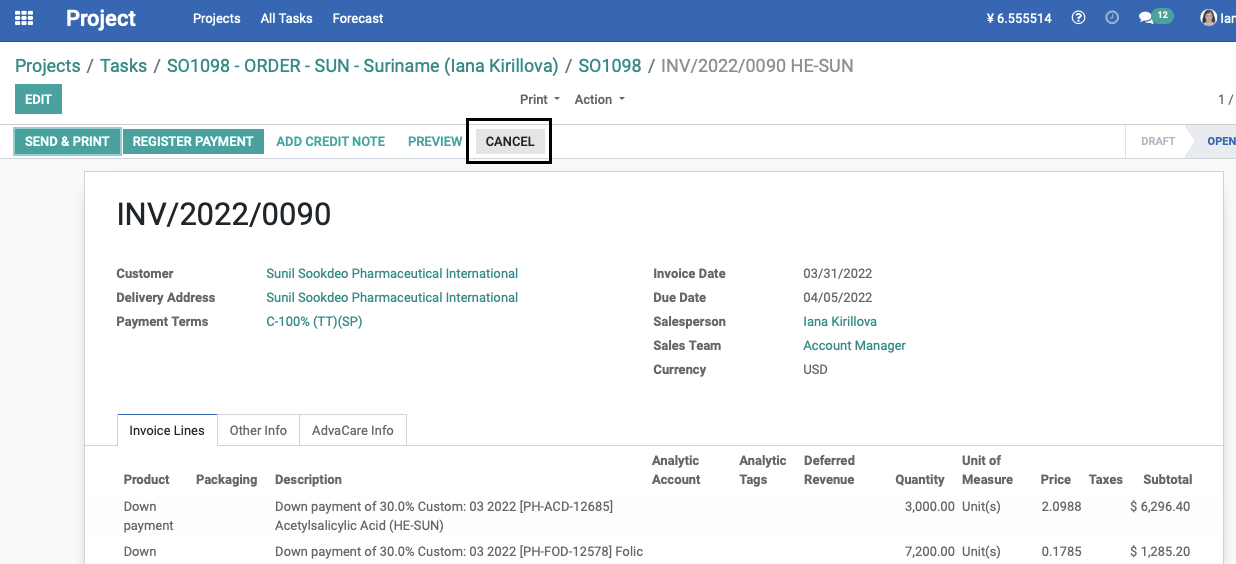

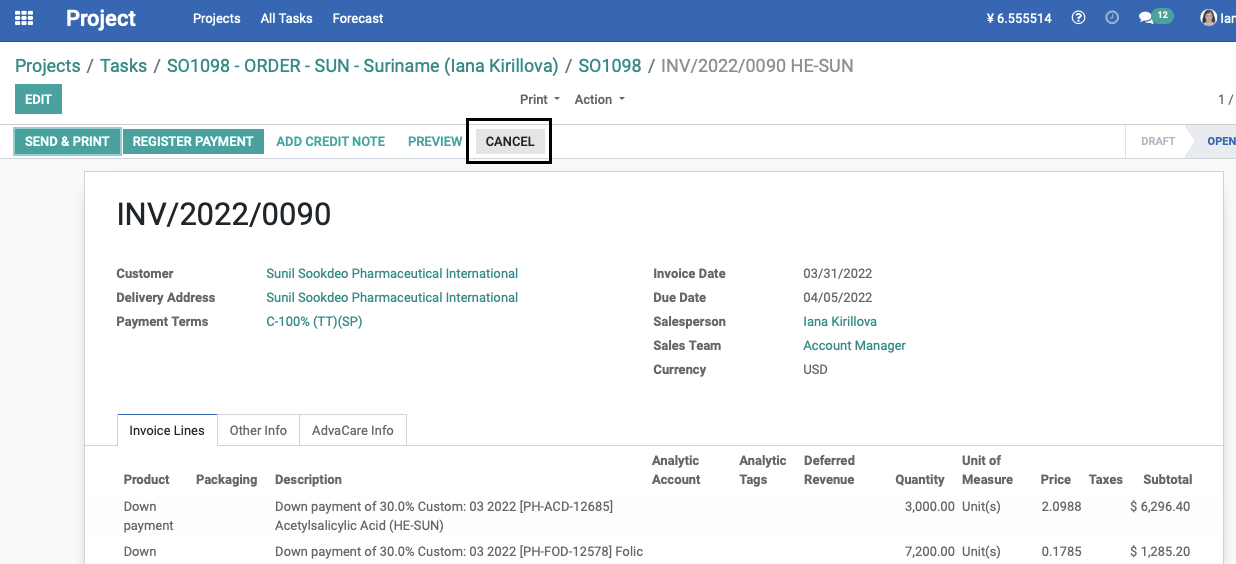

2. Locate the Accounting Invoice that has to be cancelled and click ‘CANCEL’

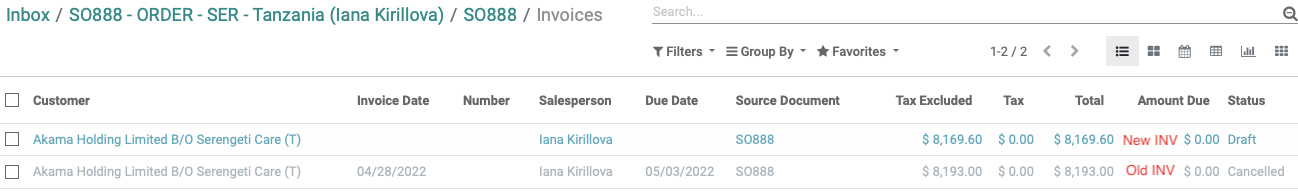

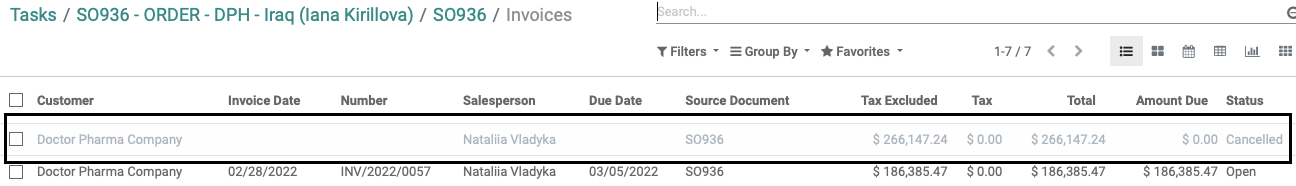

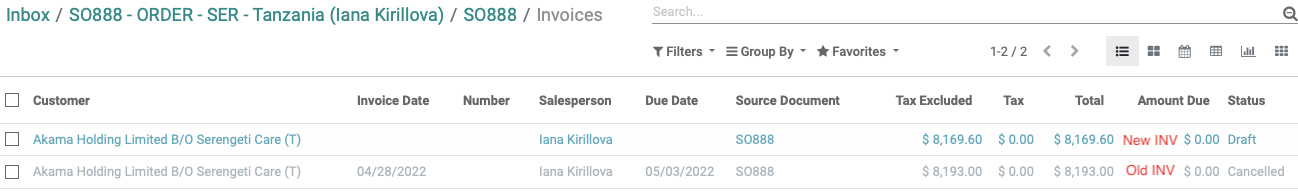

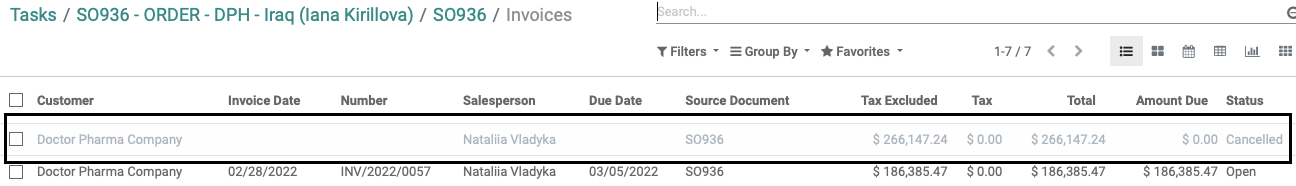

3. The cancelled Accounting Invoice will be shown in grey with status “Cancelled”, and the new Accounting Invoice will be in blue with status “Draft”:

4. Salesperson needs to generate a new Accounting Invoice.

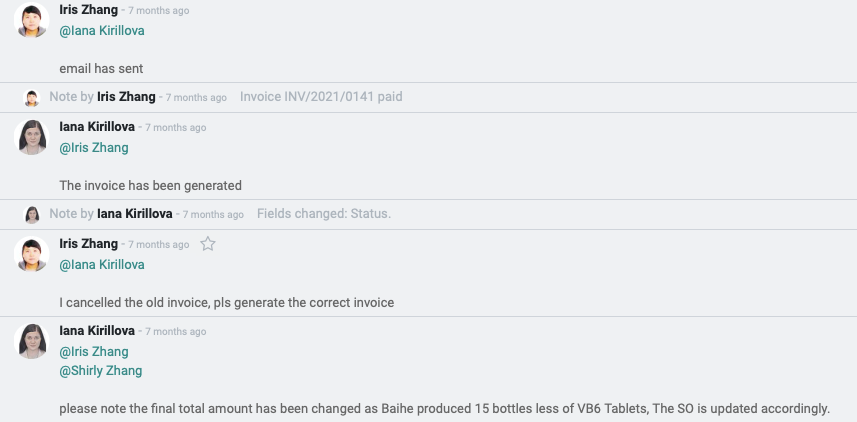

5. Salesperson is to send a task in SO chatter to the Accounting Department to inform of the cancellation of the old Accounting Invoice with the reason why it had to be revised and inform that the new Accounting Invoice has been generated.

B: Re-generating the Accounting Invoice when Customer’s payment received

If Customer has already remitted the payment based on the provided request with existing Accounting Invoice, but there are changes to the Sales Contract and the payment request has to be revised, Salesperson has to generate the new correct Accounting Invoice by taking 4 steps:

Step 1: Revise SO accordingly (as mentioned, it can be product-associated revisions, adding fees and costs)

Step 2: Send task to Accounting Dept. to cancel the existing Accounting Invoice

Step 3: Generate a new Accounting Invoice

Step 4: Send task to Accounting Dept. to inform of the generation of the new Accounting Invoice via task in SO chatter

Sometimes there are cases when the products of the order are shipped in different shipments. It can happen if there are products that have finished production first and there are other products still under production. For this reason, we need to request the final payment to the Customer for the products that have finished production and are scheduled to be shipped out. The final payment should be received before booking the shipment.

Salesperson must follow the below process:

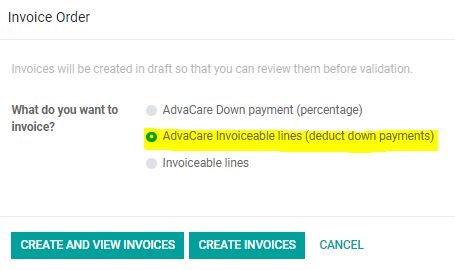

1. Generate Accounting Invoice for the Final payment of the order. Salesperson must check the consistency of the products quantities produced with quantities in SO.

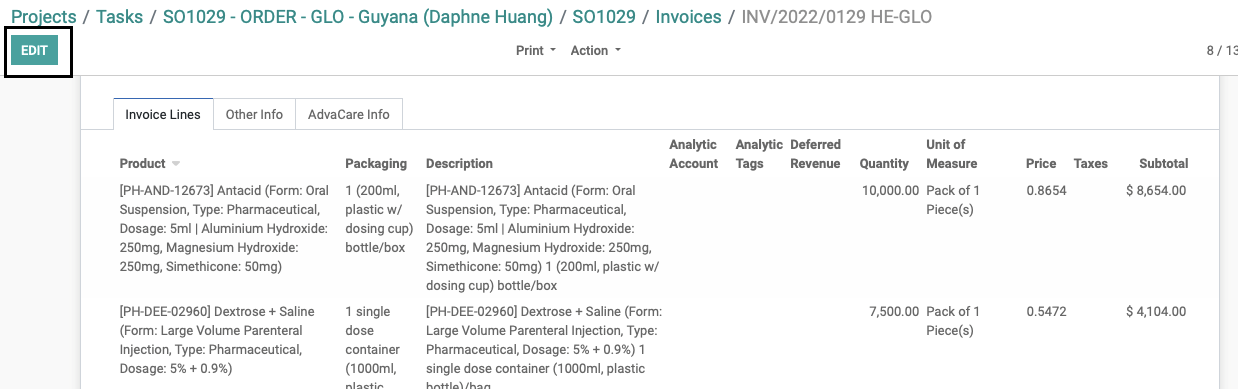

2. Click ‘GENERATE INVOICE’. The order must be in the ‘SALES ORDER’ stage.

3. To generate the final payment invoice, click ‘AdvaCare Invoiceable lines (deduct down payments).

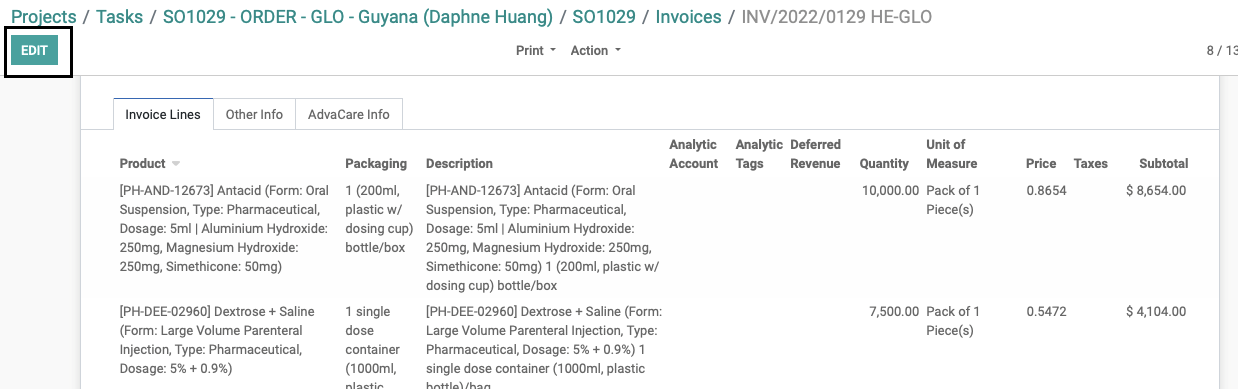

4. Locate the generated Accounting Invoice from the list.

5. Click ‘Edit’ to be able to make revisions in the Accounting Invoice.

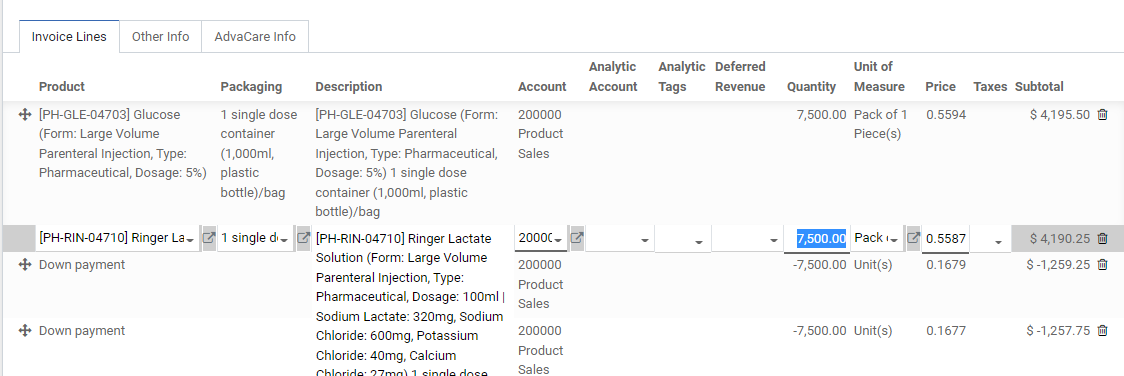

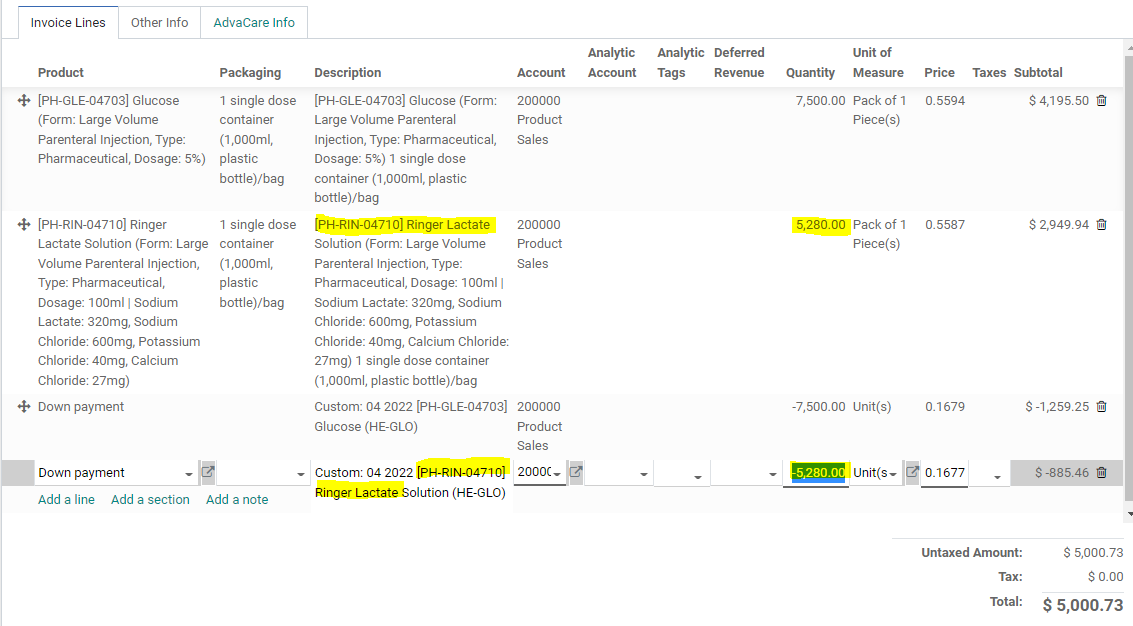

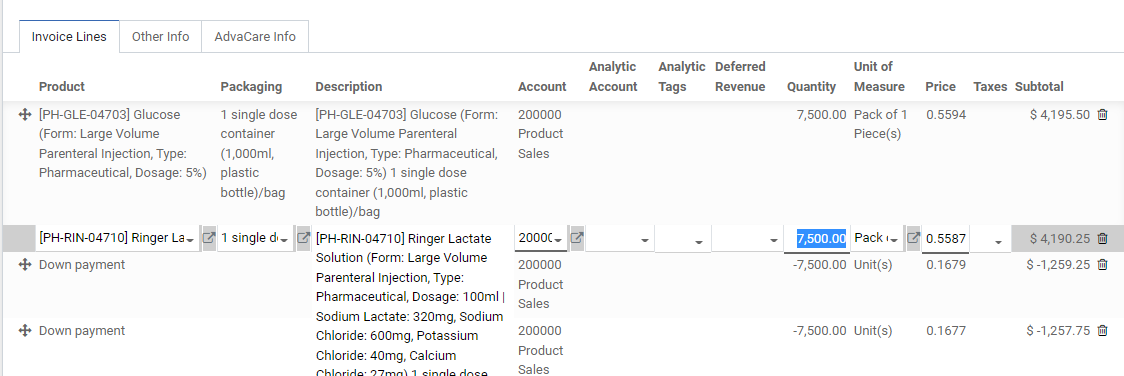

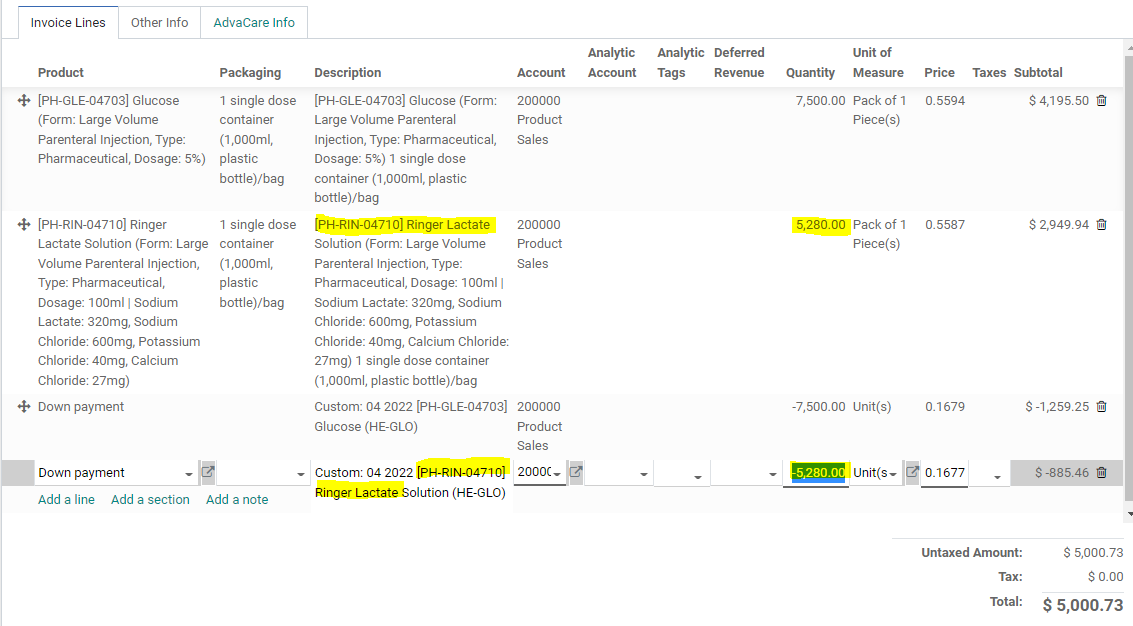

6. Revise the chosen product’s quantity to be correct, it should match with the quantity that will be shipped. Click on the ‘Quantity’ of the product. The quantity will become revisable. Now input the shipped quantity.

Note: The revision of the Accounting Invoice is available only when the Invoice is in “Draft” stage and has not been validated by Accounting Dept.

7. If a product(s) is not included in the shipment, the product(s) has to be deleted from the Accounting Invoice.

Note: the down payment line for the deleted product(s) must be deleted from the Accounting Invoice as well. Otherwise, the system will deduct the paid down payment amount from the total amount of the Accounting Invoice and affect other products.

8. The same logic applies for the Down payment lines. If a product(s) has been deleted, the down payment line must also be deleted. If the quantity of a product has been revised for the shipment quantity, the down payment line must also be revised to the same quantity.

9. After the Accounting Invoice has been generated and revised by Salesperson, Salesperson has to inform Accounting Department of the changes and send a task in SO chatter to send a payment request to Customer.

Generating Accounting Invoices for Late Payment and Storage fees

A: Generating Accounting Invoices for Late Payment Fee:

According to the payment terms stated in Sales Contract, if the Customer has failed to send the final payment by the allotted time, late fees will be applied. The fees are calculated by the Accounting Department from the date when the final payment was requested at the set percentage mentioned in the Sales Contract.

The following process must be completed in order to charge Customer for the late fees:

1. Salesperson sends a task to Accounting Dept. to calculate the late fees.

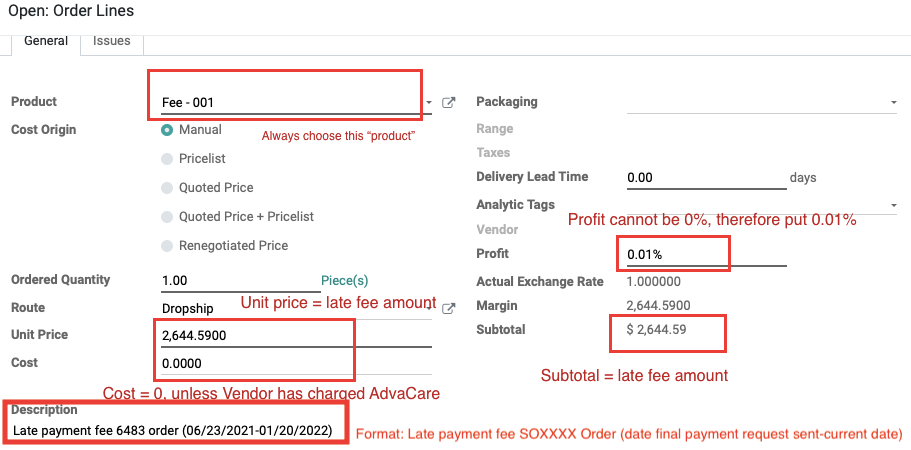

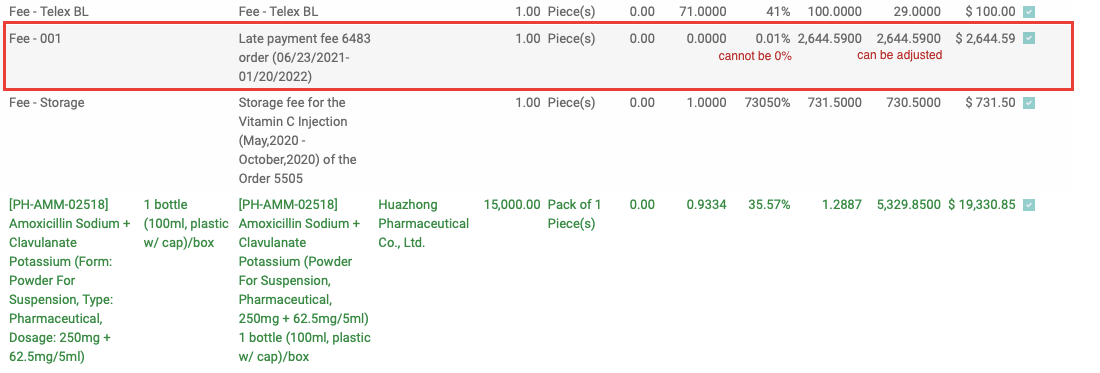

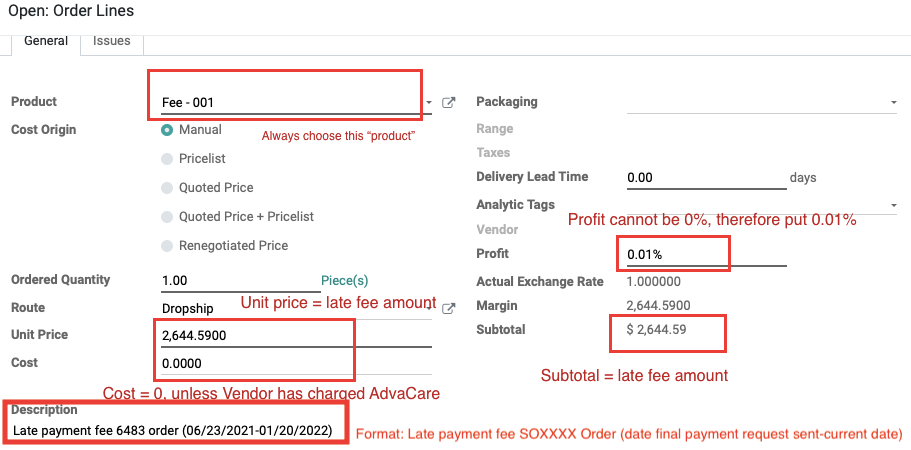

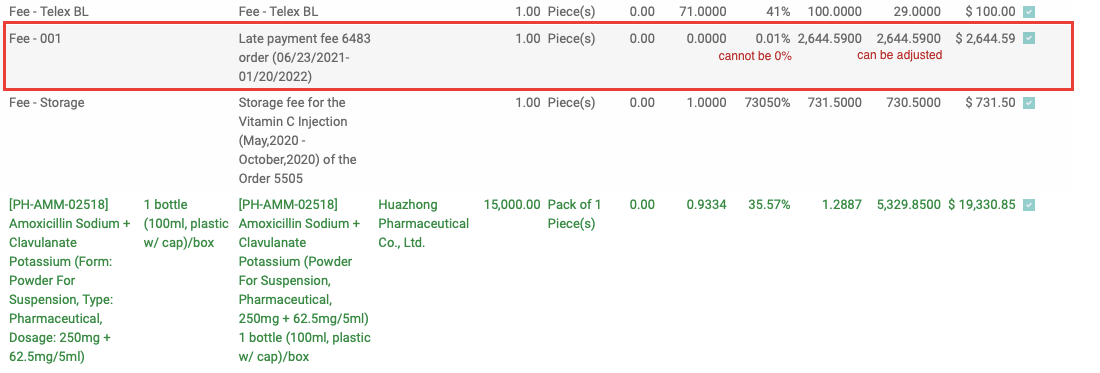

2. Add the late fee in SO in the product line.

3. To generate the accounting invoice, click ‘AdvaCare Invoiceable lines (deduct down payments)’.

4. Salesperson informs Accounting of the created Invoice for the late fees via task in SO Chatter and asks to send the Invoiceto Customer.

Note: As late fees are calculated on daily basis, the Invoice must be re-generated if the late fees were not paid within 1 week after the initial email from Accounting Dept. with the Invoice for the late fees.

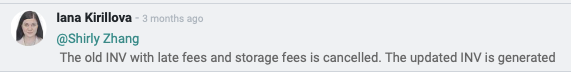

To re-generate Accounting Invoice for late fees, follow the same logic as for the Accounting Invoices for the products:

1. Send a task to Accounting Dept. to get the updated amount for the late fees

2. Cancel the existing Accounting Invoice

3. Revise the amount for the late fees and change the dates in the description

4. Generate a new Accounting Invoice and inform Accounting Department by sending a task in SO chatter

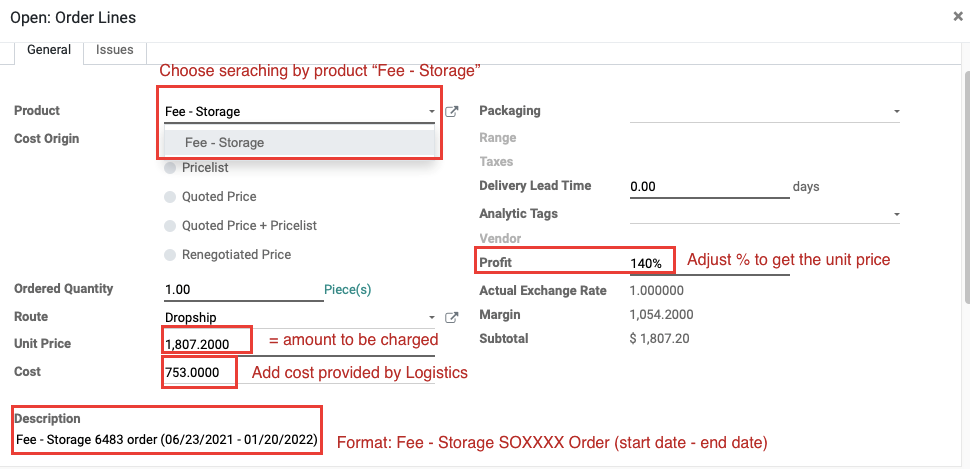

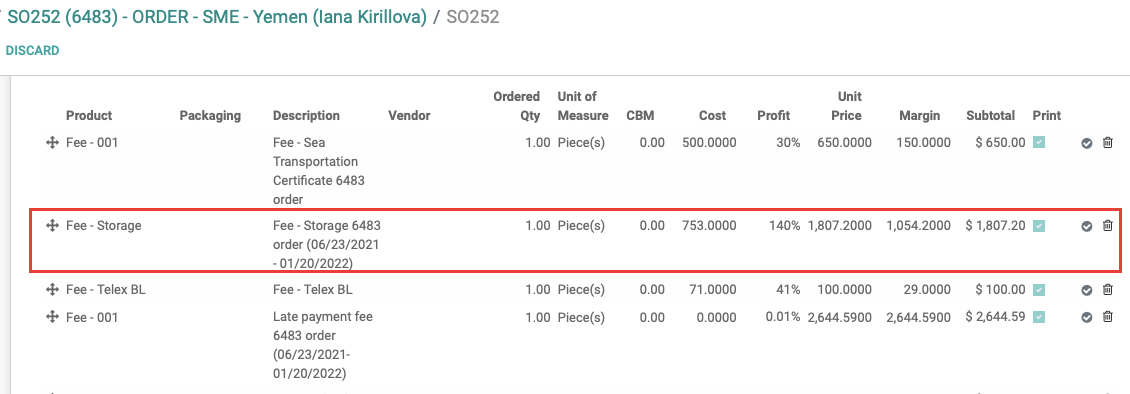

B: Generating Accounting Invoices for Storage Fee:

If the goods were moved from Vendor to a warehouse and the warehouse has started charging storage fees, the Customer has to cover this cost as it is also stated in the Sales Contract.

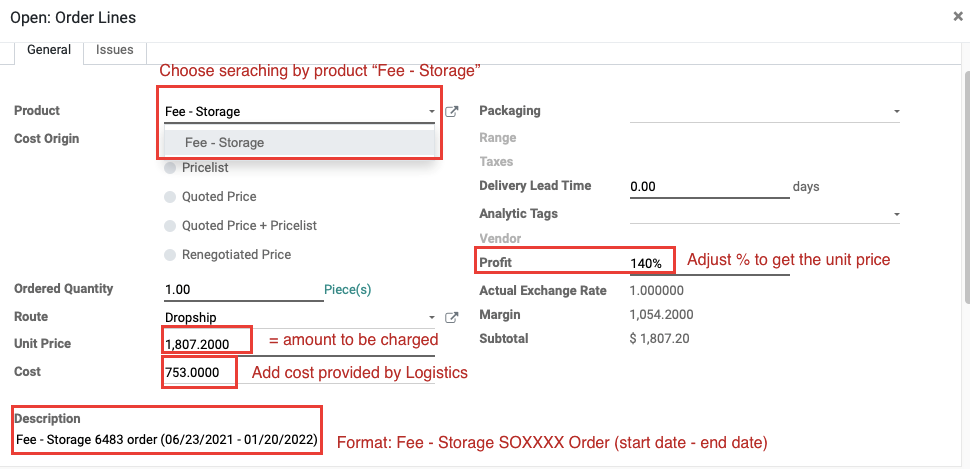

Storage fees are normally being calculated on a daily or weekly basis. The cost of the storage is provided by Logistics Department. In order to charge Customer for the storage the same logic should be applied as when late fees are being charged. Salesperson should follow the below process:

1. Send a task to Logistics Dept. to inform of the storage fee.

2. Confirm with Sales Manager if a margin should be applied and the total cost for the Customer.

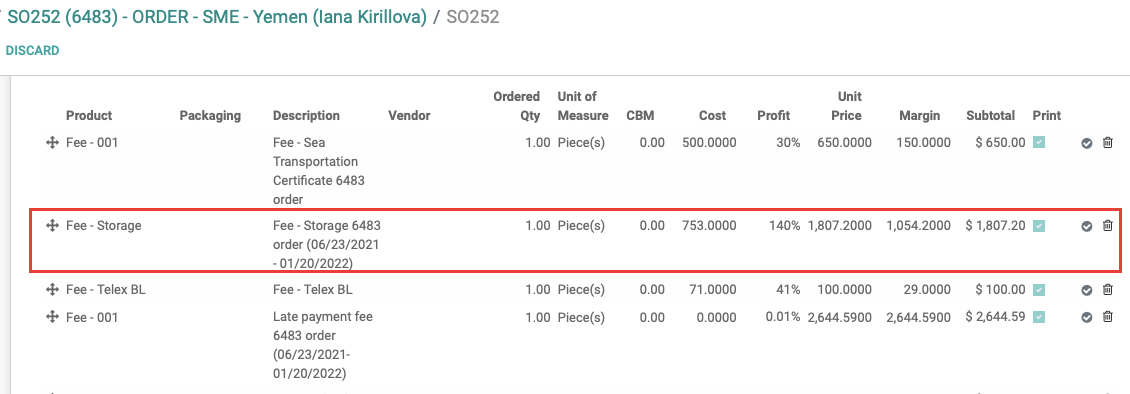

3. Add the Storage Fee in the SO.

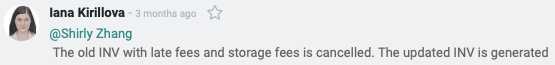

The storage fee should appear as below in the SO page.

4. To generate the accounting invoice, click ‘AdvaCare Invoiceable lines (deduct down payments’.

5. Send task in SO Chatter to Accounting of the created Invoice for the storage fees and inform to send the Invoice to Customer.

Note: As storage fees are calculated on daily basis, the Invoice must be re-generated if the late storage were not paid with 1 week after the initial email from Accounting Dept. with the Invoice for the storage fees.

To re-generate Accounting Invoice for storage fees, follow the same logic as for the Accounting Invoices for the products:

1. Send a task to Logistics Dept. to get the updated amount for the storage fees

2. Cancel the existing Accounting Invoice.

3. Revise the amount for the storage fees and change the dates in the description.

4. Generate a new Accounting Invoice and inform Accounting Department by sending a task in SO chatter.