Handling Export Declaration from India

| 5 minutesGeneral Information

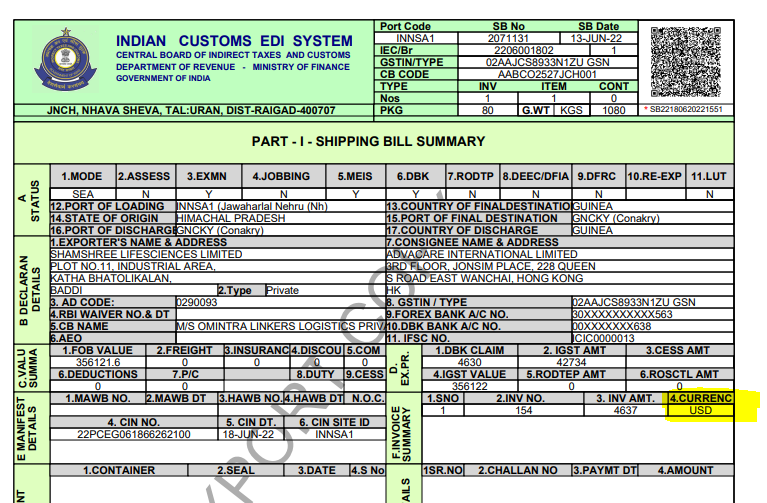

An Export Declaration form is a document that exporters submit at the port from where the goods are shipped to the importer. This form provides information about the goods being shipped including type, value and number. Customs officials in the country of export use the information on the declaration form to help track and control the level and nature of exports. The details on the form will also be used to compile data about that country’s export trade. You must complete all mandatory fields on the Export Declaration before the export of goods.

Since the “exporter" of the order in Customs is the Vendor(s), the original Export Declaration will contain the actual vendor’s prices that AdvaCare purchased the products. Therefore, it creates an issue since we do not want to provide our Customer with our vendor’s price.

The number of Export Declarations within one order can vary depending on how many vendors were producing the products. Every Export Declaration is vendor-based and contains information of all products exported from that vendor.

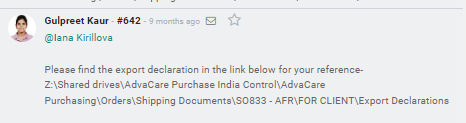

Export Declaration can be requested by the Customer as a part of the set of shipping documents. Unlike China shipments where this document is being handled by the Logistics Person and Designer, and because the shipment process is mostly being arranged by the Purchasing Dept. of India Office, the export declaration(s) will be coming from the Purchasing Dept. under request of the Account Manager.

The purpose of this SOP is to explain how to complete the revision of the Export Declaration in order to provide it to the Customer, which has to match with the rest of the shipping documents data in the shipping documents set provided to them. The task is being completed by the following stakeholders:

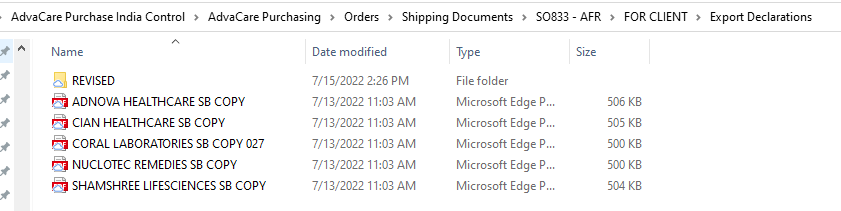

Z:\Shared drives\AdvaCare Purchase India Control\AdvaCare Purchasing\Orders\Shipping Documents\SO833 - AFR\FOR CLIENT\Export Declarations

Z:\Shared drives\AdvaCare Purchase India Control\AdvaCare Purchasing\Orders\Shipping Documents\SO833 - AFR\FOR CLIENT\Export Declarations\REVISED

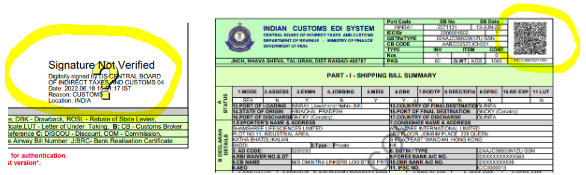

The export declaration is issued after the shipment has departed and is a 6 page digital document which is digitally signed and has a unique QR-code which proves the authenticity and allows to track the document (Note: before 2022, India Customs were issuing the Export Declarations as hard copies).

To begin with, the main points about the export declaration with India origin are:

Designer has to revise the QR-code and check via APP “ICETRAK” by scanning the revised QR-code with a phone camera where the APP is installed. The revised QR-code must NOT be valid or working.

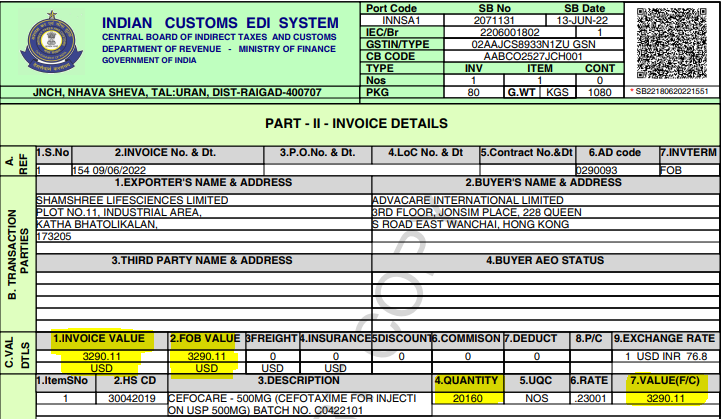

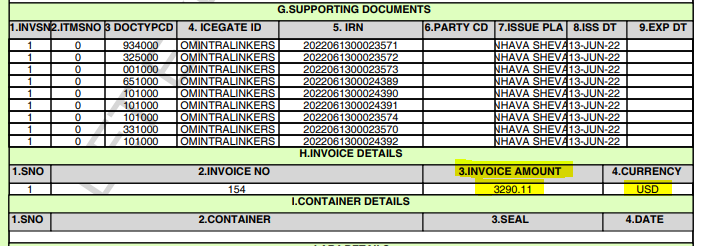

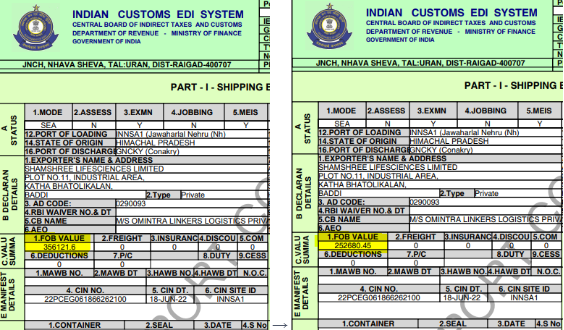

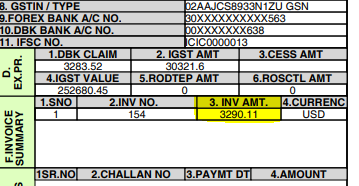

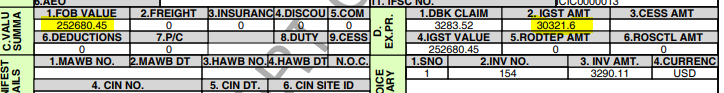

The 1st page of the Export Declaration will show that the shipment is done with USD Currency:

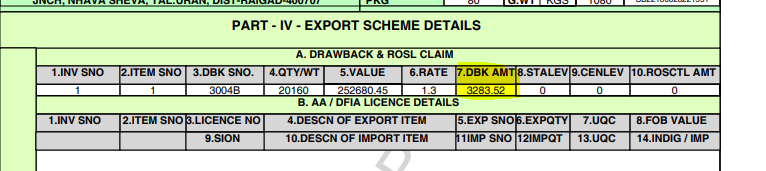

However, all data in export declaration will always be in INR.

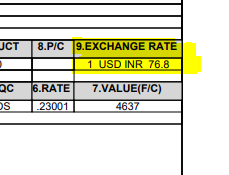

In order to complete the revision correctly, Account Manager needs to check on page 2 what the exchange rate was used when issuing the declaration:

Getting started with revisions

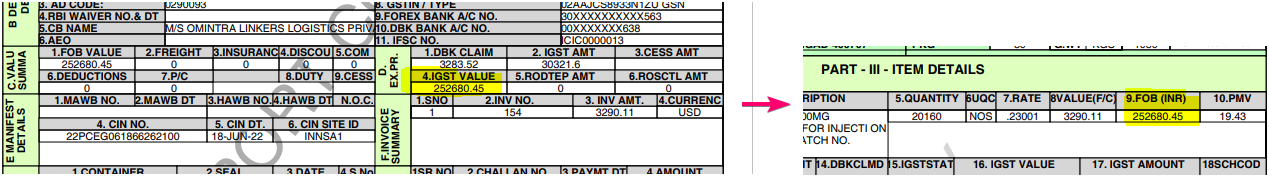

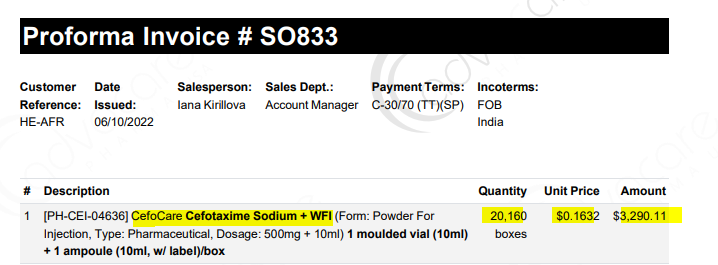

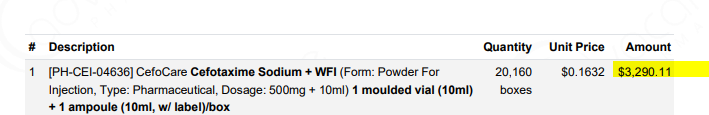

In the above example, the Customer is using CI UV and we will need to match the export declaration to these amounts.

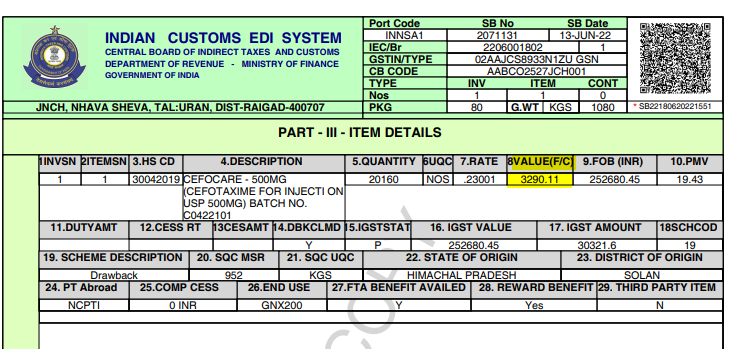

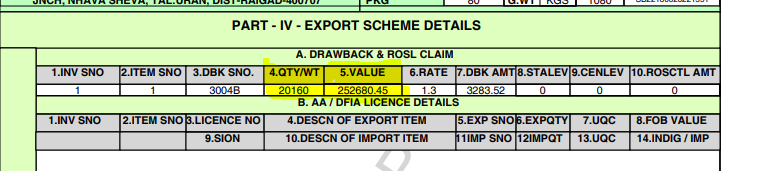

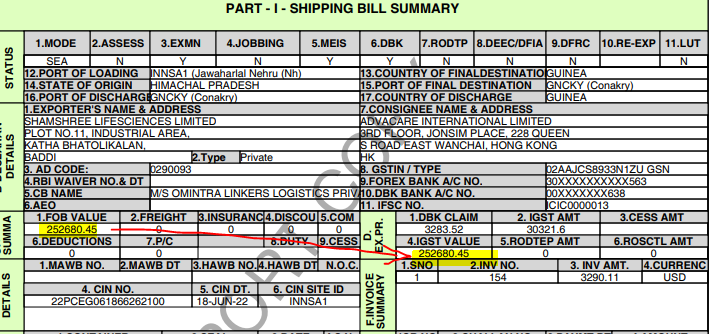

Take the total amount and multiply it by the exchange rate from Export Declaration page 2 to revise FOB VALUE:

$3,290.11 x 76.8 = 252680.45 INR

→

→

252680.45/100 x 12 = 30321.6

Both of the above points will be product-based. If 1 vendor has more than 1 product declared, then it has to be calculated for each product separately.